Press Ready or Not? The Series A Founder's Roadmap To Media Buzz

What The Data Says About Getting The Most Out Of Your PR Investments

Overview

Most Series A CEOs understand the value of establishing their company's reputation in the press. Yet, navigating how to do it effectively, what to expect, and the associated costs remain a mystery to many. A few years ago, I witnessed this challenge firsthand: I was advising a newly-minted Series A CEO who became enamored with a pitch from a very well-respected PR agency. They all but promised him the moon, boasting extensive connections to top publications like CNBC, WSJ, and The New York Times for this company’s rather run-of-the-mill product launch. Despite the high promises, the costly campaign resulted in zero articles published, a scenario all too familiar to tech founders.

Based on my own two-plus decades of Comms experience, I strongly suspected that the agency's promises were way too good to be true, but I lacked data to prove it. That experience led me to undertake a comprehensive analysis. Now, I have that data. My just-completed study of 622 articles about 45 companies that announced their Series A in October 2023 shows clear patterns. The result is a practical guide, based on real insights, that helps Series A CEOs navigate the complexities of press engagement at this stage.

Q: What Does Long-Term Success In Press Look Like For A Series A Company?

Top Tier Media Attention Is Exceptionally Unlikely for Series A Companies: The analysis showed that achieving coverage in top-tier outlets like the New York Times, Wall Street Journal, or Washington Post is incredibly unlikely at any point for Series A companies. In fact, among the 45 companies analyzed, not one achieved coverage in these outlets. This lack of coverage isn't a reflection of these businesses being uninteresting or lacking innovation; rather, it's because these prestigious outlets are not wired to cover companies at such an early stage.

Nevertheless, You Have Nearly Even Odds For Landing Upper Tier Coverage: 58% of the companies in this analysis secured a story in an Upper Tier outlet at some point in their history (such as Axios, CNBC, Fortune, Forbes, TechCrunch, and others; see the “Methodology” section below for the full definition of Top vs. Upper vs. Mid vs. Lower tiers).

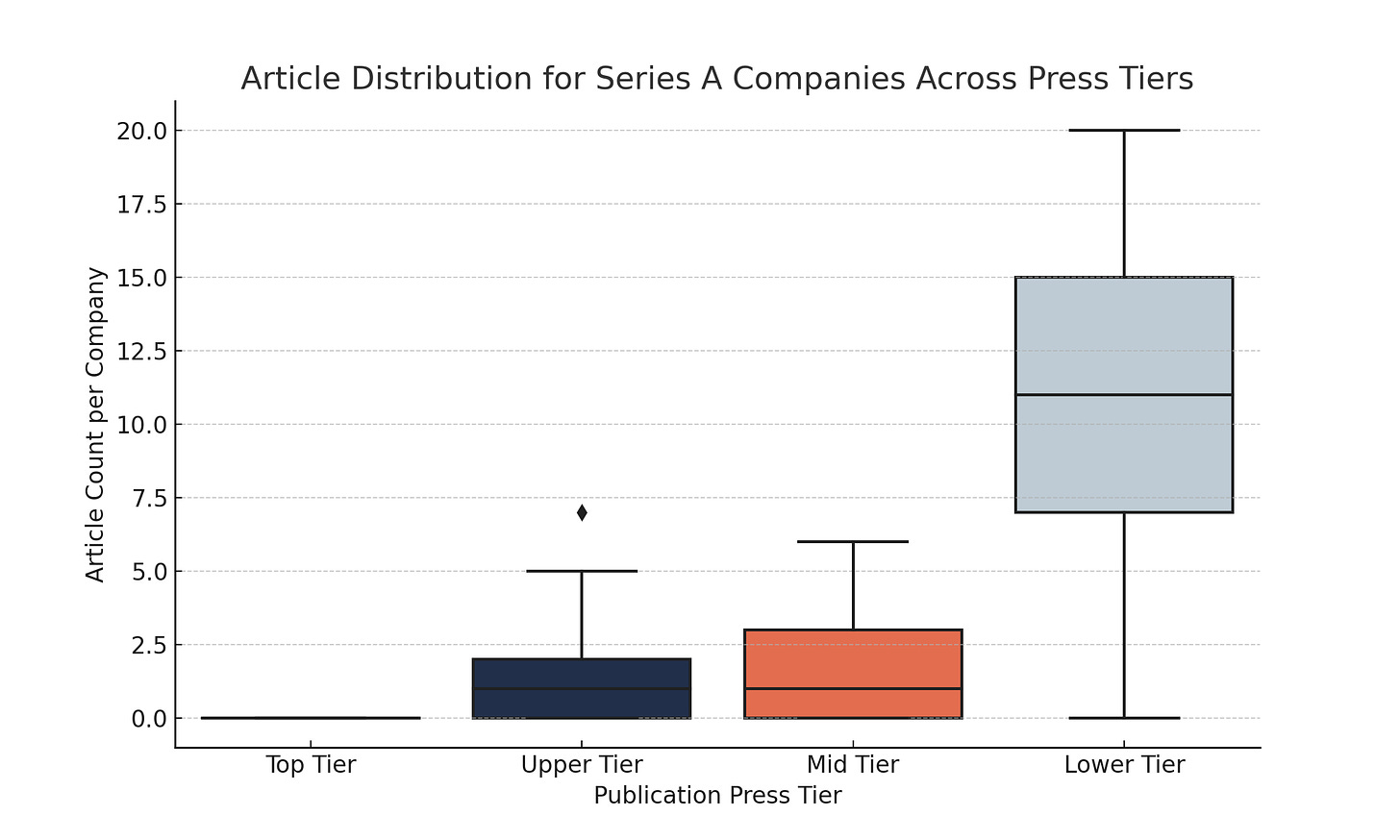

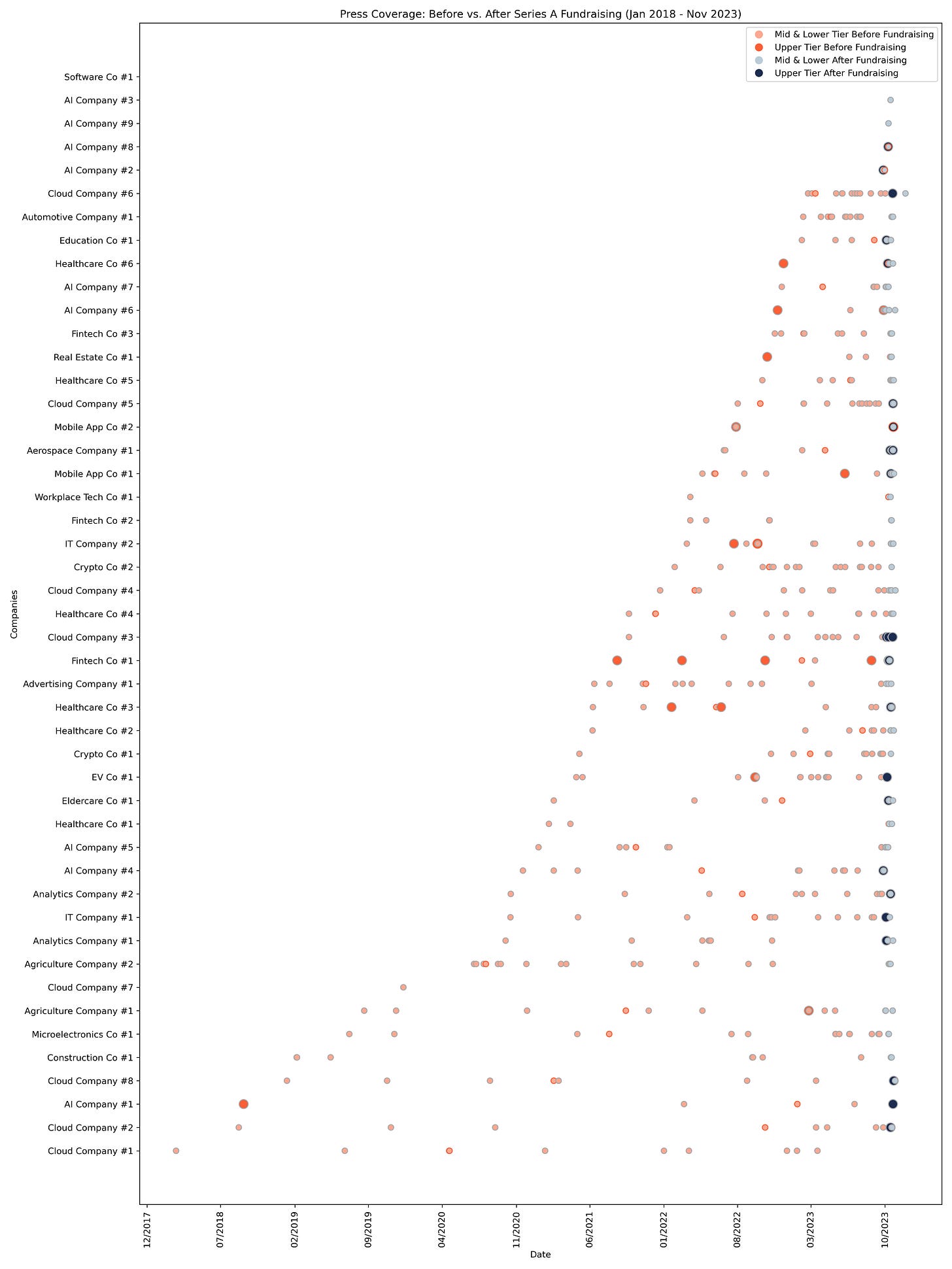

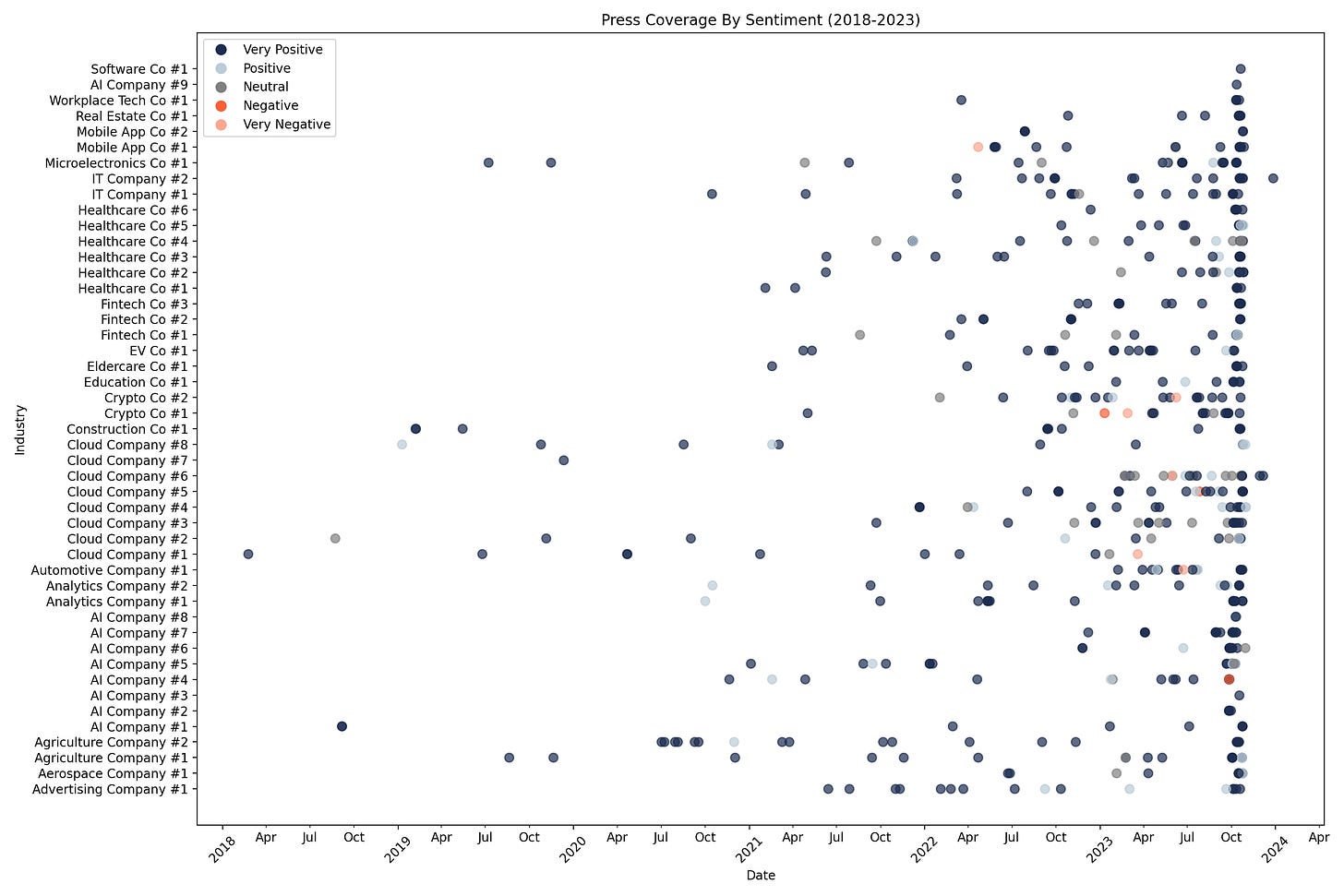

Total Press Footprint: The average Series A company in this analysis had a lifetime press footprint of 14 articles on Google News shortly after their Series A announcement. On average, 9 stories were generated prior to their funding announcement, and 5 after. It should be noted that the next chart is challenging to read, but it shows every story for each company in the analysis from 2018 through October 2023. It provides a good sense of the frequency of press coverage over the young lifespan of a Series A company.

Note: Each company name has been anonymized, but a general description of their industry has been retained.

Q: What Outlets Are Most Likely To Cover My Company At This Stage?

Top Tier: As mentioned earlier, the most prestigious publications, such as The New York Times, The Washington Post, and The Wall Street Journal, are nearly unattainable for most Series A companies for any type of news (for example: product announcement, fundraising, etc.), with zero coverage in this sample. While rare placements do occur, they are typically the result of a company fitting squarely into broader media narratives already underway rather than being due to skilled PR pitches

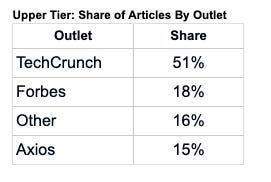

Upper Tier: TechCrunch emerges as the most likely landing spot. In fact, 51% of stories about Series A companies in Upper Tier publications appeared in TechCrunch. It's widely recognized as a dominant force in covering early-stage companies, and the extent of its share concentration was surprisingly high. Forbes and Axios are within reach, although the likelihood of coverage diminishes significantly beyond these outlets.

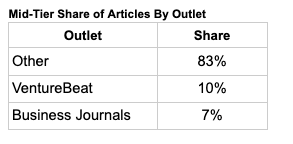

Mid Tier: VentureBeat emerged as the most prolific publication in this tier, publishing several articles, albeit with a relatively low share of overall coverage. Important coverage was also noted from local business journals (example: The San Francisco Business Times), which often highlight local companies. Beyond these, 83% of stories originated from a diverse mix of outlets, primarily from trades and local market publications. The key takeaway is the substantial opportunity available with mid-tier outlets. This tier offers significant potential to gain credibility for your business. Do not underestimate their importance; they are prominent in SEO, are tracked closely by your investors and and tend to align closely with your desired message.

Lower-Tier Coverage: These outlets are often lesser-known publications, many of which syndicate press releases or reproduce content from other articles. On average, Series A companies generated about 12 stories over time in these Lower Tier outlets. Lower Tier outlets frequently pick up stories without direct pitches. While they are often underestimated, it is crucial to be mindful of these outlets for two reasons: they significantly enhance SEO visibility, and they often adhere closely to a company's intended message. Although not nearly as influential as Top and Upper Tier outlets, their role in shaping a company's reputation is still significant.

What Factors Did (and Didn’t) Make Difference?

Funding Amount - No Impact: When it comes to fundraising announcements, correlation and regression analyses indicate that the size of the funding had no discernible impact on press outcomes. This suggests that the amount raised is not a determining factor in media coverage.

Lead Investor - No Impact: Interestingly, there was no significant connection between the identity of the lead investor and press outcomes. This challenges the notion that having a high-profile investor automatically translates into more media attention.

Fundraising As A Press Hook- Positive Impact: As one might expect, fundraising events are pivotal in breaking into Upper and Mid-Tier press outlets. In fact, fundraising was the central theme in 63% of all stories in Upper Tier outlets, underscoring its importance as a hook for media coverage.

Non-Traditional HQ Geographies - Positive Impact: In an intriguing departure from the norm, all ten companies with the highest average sentiment scores were located outside traditional tech hotbeds. Remarkably, these companies posted sentiment scores 19% higher than their counterparts in tech hubs like the Bay Area and New York, which ranked among the lowest in sentiment score.

Q: How Much Should I Worry About The Risk of Bad Press?

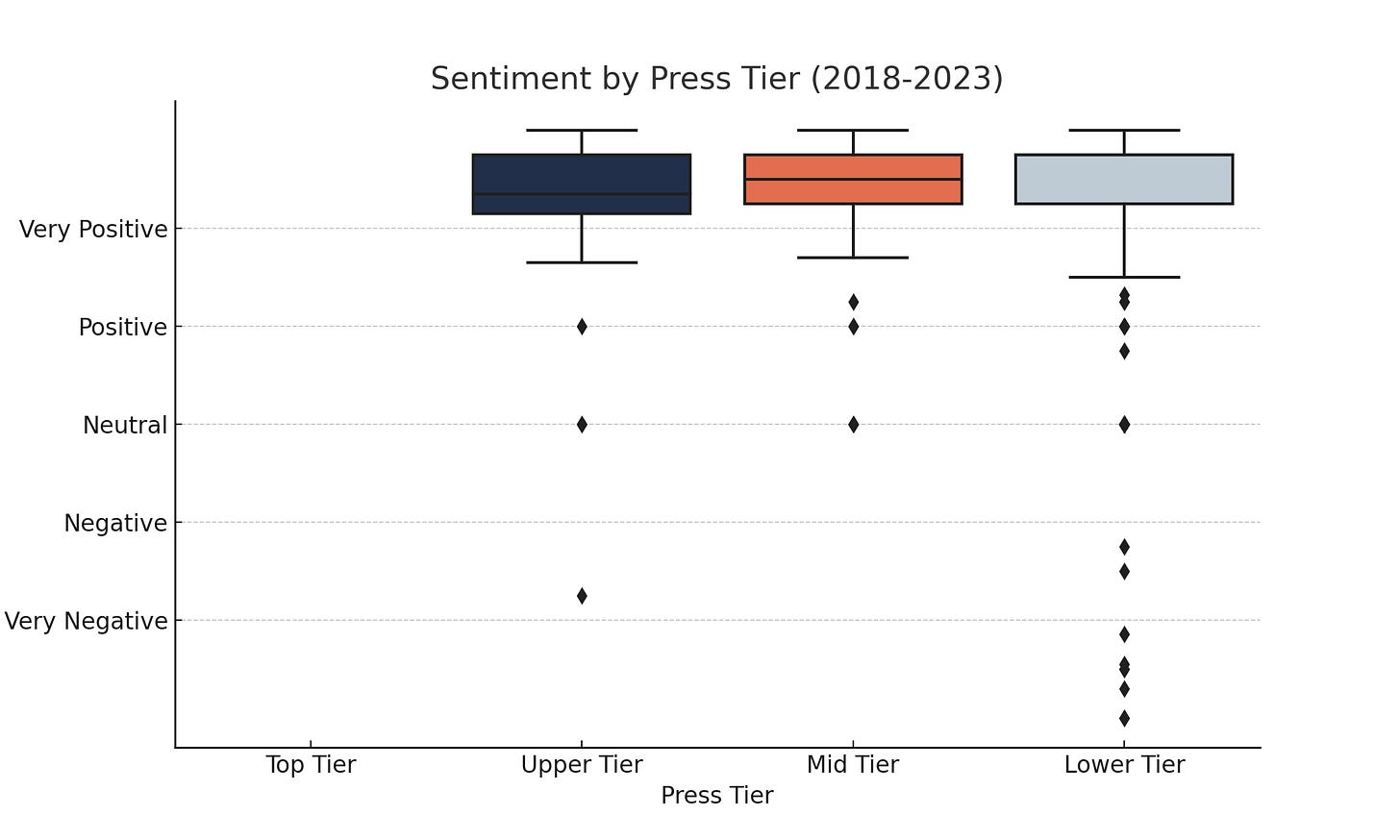

Expect Positive Sentiment: More than 90% of all stories about Series A companies carried a 'positive' or 'very positive' sentiment, a trend consistent across all tiers. For Series A companies, this generally means you're receiving the benefit of the doubt regarding your business's potential.

Let’s look at that visually for the 44 companies in this analysis:

I was curious about how sentiment evolves over time, yet no clear trend line emerged from the data. When these companies had missteps, they were called out for it in the press. But for the most part, the media seems to almost universally lean towards giving Series A companies the benefit of the doubt. Enjoy this phase while it lasts, as the landscape will inevitably include far more negative sentiment as companies grow and mature.

Lets’s also look at that visually (apologies for another eye-chart):

Q: How Can I Achieve More In-Depth Media Coverage?

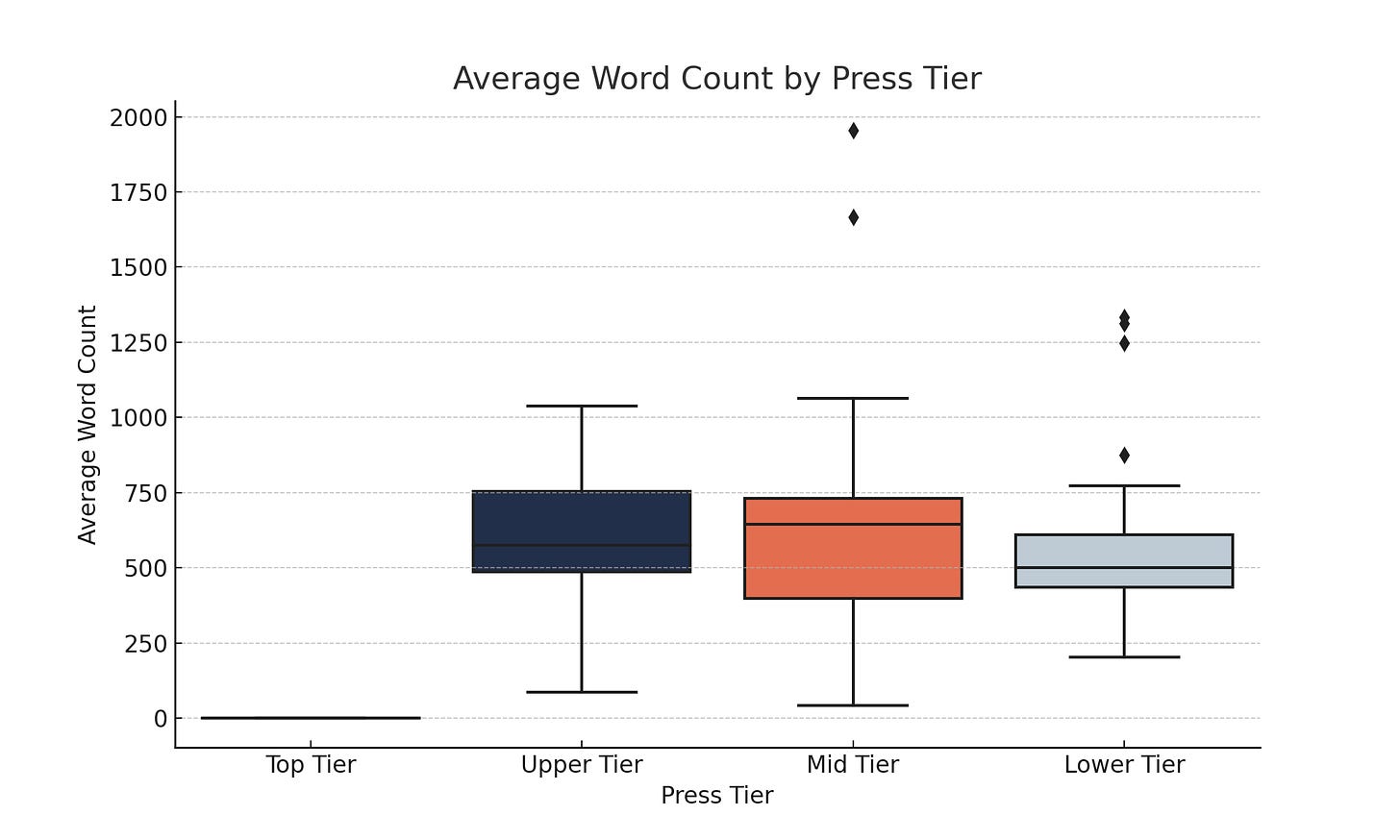

So, if you're putting in significant effort and investment to generate press coverage, it's crucial to ensure that the resulting stories accurately reflect key aspects of your business. How can we increase the likelihood of achieving the depth of coverage you deserve? Let's consider word count as an indicator of depth, on the assumption that longer stories equate to more comprehensive coverage.

The analysis showed a consistent pattern: articles in Upper and Mid Tier outlets typically had more depth in terms of word count, while those in Lower Tier outlets were slightly shorter.

However, the analysis also revealed a counter-intuitive insight: Articles of standard length (fitting within the 'box' in our analysis chart) had sentiment scores approximately 8.5% higher than longer articles (represented by the lines extending above the boxes, known as 'whiskers').

What does this imply? It appears there's a 'sweet spot' in terms of content length for press coverage. My hypothesis: lengthier articles may create more opportunity for counter arguments. It's similar to delivering a good investment pitch – being clear, concise, and to the point is often more impactful. For Series A founders navigating the media landscape, it's important to remember: the effectiveness of your communication is not just about the content but also the conciseness of your message.

The Bottom Line

For Series A startups, the press success is less about chance and more about understanding the terrain. This means embracing a strategy informed by data, not just aspirations.

This analysis, though based on just one month's data, reveals clear patterns.

While landing a feature in Top-Tier publications is very unlikely, there are fertile grounds for media engagement in Upper and Mid-Tier outlets. Furthermore, Lower-Tier coverage shouldn't be discounted as it plays a significant role in enhancing online presence. These are the arenas where your press efforts are more likely to bear serious fruit. Focus your efforts and dollars where you can make a real impact. The key takeaway is? Smart press engagement is rooted in aligning your efforts with the insights revealed by data. Tailor your approach to target the right outlets, craft compelling narratives, and build credibility steadily. That's how you build your reputation effectively and efficiently at this stage of your journey.

I plan to revisit this analysis periodically to spot new trends as they emerge over a longer period. I also have insights into which journalists are most likely to provide the highest sentiment results. If you’re interested in talking more, give me a call.

Was this helpful? Please share with fellow founders and ket me know what you think!

The Fine Print: Methodology and Background

Scope: Evaluated all available press coverage of companies announcing fundraising (Series A to E) in October 2023. Source = Crunchbase

Total Articles Analyzed: 1,370 (Series A - E). 622 specific to Series A.

Data Source: All articles were sourced from Google News, focusing on the first 5 pages for each company (10 articles per page). Note: In a small number of instances, companies had more than 5 pages of coverage on Google News. However, these were mostly incidental mentions and not material to this analysis.

Coverage Period: Articles from June 2014 thru October 2023 were included (with the overwhelming majority between 2018 and Oct 2023)

Methodology: Used GPT4.5 to analyze each article a proprietary mix of 11 unique attributes for each business, and 20 unique attributes for each article.

Exclusions: Did not include TV, radio, podcast, or other non-text-based coverage due to cost and time constraints. Does not include non-English language coverage. Also does not include newsletters. I’ll likely look at these in the future.

Inclusions: Press releases and self-generated articles appearing in Google News are part of the analysis.

Press Outlet Tiering

Here is the press release tiering used for this analysis. Apologies in advance to anybody who feels a particular outlet was not properly tiered (feel free to email me if you'd like to discuss). This tiering system will get honed over time.

Top Tier: BBC News, Financial Times, Harvard Business Review (HBR), New York Times, The Guardian, Vanity Fair, Wall Street Journal, and Washington Post.

Upper Tier: ABC News (national), Al Jazeera English, Axios, Barron’s, Bloomberg, Business Week, BuzzFeed News, CBS News (national), Chicago Tribune, CNBC, CNN, Entrepreneur, Fast Company, Forbes, Fortune, Fox Business, Fox News, Good Morning America, Harvard Business Review (HBR), Los Angeles Times, MSNBC, NBC News (national), National Public Radio (NPR), New York Magazine, Newsweek Politico, ProPublica, Quartz, Reuters, TechCrunch, The Associated Press (AP), The Atlantic, The Economist, The Hill, The Information, The Nation, The New Yorker, The Telegraph, The Today Show, TIME Magazine, USA Today, Vox, Wall Street Journal, Washington Post, Wired,

Mid Tier: Ars Technica, Bustle, Cheddar, CNET, CleanTechnica, Digital Trends, Engadget, GeekWire, Gizmodo, Huffington Post, IndieWire, Lifehacker, MarketWatch, Mashable, Mother Jones, New York Post, Rolling Stone, Salon, Slate, The Daily Beast, The Verge, VentureBeat, Vice News, Yahoo, Yahoo News, and ZDNet, High-quality trade publications relevant to each company, Other publications of particular influence to early-stage venture-backed companies; High quality local market publications specifically relevant to each company.

Low Tier: Any outlet not mentioned in other tiers, including press release wire services. For this analysis, 266 unique outlets had stories in this tier.

Love this, Will! I'm one of those founders who has struggled to understand the value, or the secret sauce of traditional PR. I'm hoping for a future post where you correlate coverage with valuation growth!

Will, thanks for this thoughtful analysis and sharing data to help Series A founders make informed decisions. I can't count how many times I've chatted with Seed/Series A founders about whether or not PR/comms make sense - will be sharing this with them going forward as a useful resource!